As a child growing up in India, there were only two or three entertainment companies by which I used to get to see English content, of which Disney cartoons was one and so the moment I ran into this Disney Business Model of 1958 a few weeks back it struck a chord with me..

My objective then was to understand the model and see if it is still relevant in today’s world and the emerging streaming world… particularly as this is now my bread and butter…

A little bit of history to start with…

The company Walt Disney started from a cartoon studio set up with his brother Roy in 1923 and grew in line with his ambition to reflect his disparate array of talents.

An animator first and foremost, Walt created and licensed Mortimer (later Mickey) Mouse in response to losing the rights to his first character, Oswald the Lucky Rabbit. in 1930, Disney produced its first animated feature films. “Snow White and the Seven Dwarfs” followed by “Pinocchio” and “Fantasia” (1940), “Dumbo” (1941) and “Bambi” (1942).

The company diversified further in the 1950s, opening the original Disneyland theme park in California.

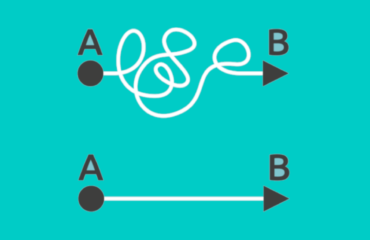

The business model drawn by Walt Disney in 1957 has films at the centre surrounded by theme parks, merchandise, music, publishing and television.

At the centre are the Disney Studios, and rightly so. Not only does differentiated content drive movie theatre revenue, it creates the universes and characters that earn TV licensing revenue, music-recording revenue, and merchandise sales

At the end is Disneyland where the characters created by the studios and which have become popular through the movies and the TV come to real life.

Even after the passing away of Walt, the company has continued to follow the said business model of keeping content at the core of the company

Disney has skillfully capitalized on their intellectual property: and in the industrialization of mythology.

Its success rests on its mastery of the three elements of modern myth making: tropes, technology and toys.

Disney properties, which include everything from “Thor” to “Toy Story”, draw on well-worn devices of mythic structure to give their stories cultural resonance.

The internal mechanics of myths may not have changed much over the ages, but the technology used to impart them certainly has. That highlights Disney’s second area of expertise. In earlier times, legends were passed on in the form of dactylic hexameters; modern mythmakers prefer computer graphics, special effects, 3D projection, surround sound and internet video distribution, among other things.

And the company has kept this at the forefront while making acquisitions also as shown in two cases below:

When Disney bought Lucasfilm, it did not just acquire the Star Wars franchise; it also gained Industrial Light & Magic, one of the best special effects houses in the business, whose high-tech wizardry is as vital to Marvel’s Avengers films as it is to the Star Wars epics.

And when Disney was left behind by the shift to digital animation, it cannily revitalized its own film-making brand by buying Pixar, a firm as pioneering in its field as Walt Disney had been in hand-drawn animation. Moreover, modern myths come in multiple media formats.

In addition, these days’ myths are also expected to take physical form as toys, merchandise and theme park rides. This is the third myth-making ingredient. Again, Walt Disney led the way, licensing Mickey Mouse and other characters starting in the 1930s, and opening the original Disneyland Park in 1955.

But how has Disney maintained this over decades?

What has set apart Disney is its determination to put storytelling at the heart of its business, and its ability to get its hands on new characters capable of bringing fans back repeatedly.

It has also excelled at refreshing and repackaging its franchises to encourage adults to revisit their childhood favourites and, in the process, to introduce them to their own children…

So they have in a way combined

- Archetypal storytelling,

- Clever technology

- Powerful marketing

How does all this add up in the changing market scenario with streaming services eating away into traditional Cable TV subscribers?

The major players in the internet based streaming market can be categorized into two:

- YouTube that is an ad-based service…All kinds of advertisements can ride on this as the content is search based and the customers can be therefore categorized according to the search.

- Netflix, which is subscription-based, which is broadly similar to Cable TV, but without the intermediaries and advertising. That results in a far better experience for consumers, who can watch what they want when they want it without any disturbances.

Netflix is an Aggregator, leveraging its massive subscriber base to buy the shows it wants The focus for Netflix will be having all types of shows for all kinds of people all being charged a slowly-but-surely rising monthly rate. To put it another way, the best way to think about Netflix is not as a channel but rather as the new cable company, albeit one solely focused on evergreen content.

Disney is addressing these two main categories with a three- pronged strategy still based on the traditional model that runs like this:

1.Disney +

The best way to understand Disney+, starts with the name: this is a service that is not really about television, at least not directly, but rather about Disney itself. This famous chart created by Walt Disney himself remains as pertinent as ever:

This is the only appropriate context in which to think about Disney+. While obviously Disney+ will compete with Netflix for consumer attention, Disney, and be profitable the larger picture has to be with Disney content.

By controlling distribution of its content and going direct-to-consumer, Disney can deepen its already strong connections with customers in a way that benefits all parts of the business: movies can beget original content on Disney+ which begets new attractions at theme parks which begets merchandising opportunities which begets new movies, all building on each other like a cinematic universe in real life

This is also why Disney + is so comfortable with aggressively pricing its product to take on the competition.

2. ESPN+

One of the smartest moves Disney made in the last decade was going on a huge sport rights buying binge. Rights are the most valuable commodity for this business model, and Disney tried to buy all of them.

Enter ESPN+: this service is not a new business model; it is simply an opportunity to earn incremental revenue on the assets (sports rights) that ESPN has already invested in.

So ESPN+ will become the one stop shop for sports action owned by Disney.

3. Hulu

Hulu will be the Netflix competitor from the Disney stable. As long as Hulu is around Netflix is not the only alternative for selling streaming rights or original content that happens to exist for its own sake, not because it is part of something bigger, Disney, of course. Hulu also sells the traditional cable bundle as a streaming service, something else Disney remains interested in supporting.

It will also be interesting to see what sort of bundle offer Disney comes up with for Disney+, Hulu, and ESPN+; thanks to Hulu Live that bundle could include basically all types of content except what is on Netflix (and Amazon Prime Video and Apple TV+ ).

As can be seen the famed model still stays relevant with some of the blocks replaced by the newer distribution paths which have come about. However, the concept of keeping content and studios at the centre and encompassing their usage through multiple distribution means and feeding back into the studios is still so valid.

I argue this model is the most critical inheritance Walt Disney has left and what continues to make Disney the one of the richest companies and most highly regarded companies in the world.