When was the last time you went from shop to shop to check out different brands and models or colour and pricing of a TV or refrigerator that you wanted to buy… Long time ago wasn’t it?

The Indian consumer durables industry has been growing at a compounded annual growth rate of 17% for the last 5 years and is expected to reach USD 20.6 Billion by 2020 making it the 5th largest in the world.

This seems to be a dimensional change for an industry which hardly had any global brands till about 17 years ago… Where home-grown brands shared 80% of the market share… where you had a small retailer in every prominent village or town whose recommendation was the Bible for most purchasers… where you had to wait days for a service technician to turn up in case your TV broke down and so on…

The opening up of the economy in the 90s led to an onslaught in the sector with price warriors like Akai, Aiwa and others fighting on the price front while global MNCs like Samsung, LG, Sony and Haier entered the other segments with latest technology and products. This double-sided attack led to erosion of market shares of all the Indian grown brands with several of them having to wind up their businesses.

In addition, the changes in infrastructure segments like telecom and roads and increased spending power and availability of cheaper and easier finance options also changed the retailing side of the industry.

With better access due to improved road networks and logistics, the start of organised retailing commenced which led to the demise of the individual trader in each village as he couldn’t compete with the multi- location modern trade showrooms neither on price, display or ambience. Today this channel contributes to more than 30% of the durables sales.

In the consumer durables industry, Flat Panel TVs account for 38% of the total market spends, followed by refrigerators with 27%, Air conditioners with 20% and washing machines with 13%.

The lower tier cities (cities with population < than 0.1 million) have been increasing their share in the total sales of the durables market with higher growth rates. Today the contribution from these cities has grown to 18% of the total sales backed by 30 to 50% YOY growth rates.

Attached below is the value growth within some of the key categories:

Value growth within segments

In the washing machin segment front loading machines have grown by 25% while the semi automatic has grown by only 18%

Similarly in the AC segment while spilt has grown by 32% window has only grown by 19%

The data above also indicates the higher growth in the premium categories in all the segments. The higher end consumables with enhanced features and functionality are the preference of every homemaker.

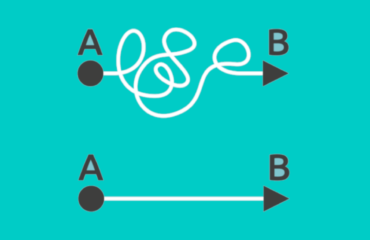

However today, the increased penetration of the internet, wider usage of smart phones and increased competition and spend by the e commerce players is again altering the dynamics of the consumer durables industry. With these options, knowledge, access and information of all models, brands and offers are available instantly to all markets and all categories.

This has resulted in several brands particularly in Mobile phones and Televisions entering India through only e commerce companies like Lenovo or Red me. Several earlier popular brands are also getting relaunched and re-establishing market shares through the e commerce channels.

These and the proposed tie ups between several e-commerce players with organised retail like amazon tie-ups up with Shoppers shop and Flipkart joining hands with Kishore Biyani and implementation of GST! The dimensions of the consumer durable industry in India are set to be altered again …